Xplico CapTable

Based on more than 10 years of experience and supporting 100 life science companies with powerful valuation analysis, Xplico has built an advanced capitalization tool tailored to simplify complex ownership structures of life science industry. Keeping track of “who owns what” in multilayered ownership structures of life science companies and “what happens if” in various investment and exit scenarios is a time-consuming task for company managements. Different types of shares, outstanding warrants, individual preference rights, interest on investments, anti-dilution protection terms and other conditions are among variants that can complicate the structure. Xplico CapTable is an easy-to-use standardized Excel-based tool which is built and tailored to facilitate syncing up, updating and keeping accurate track of multiple ownership and exit scenarios: What is the investors’ return on their investment? When will the shares and warrants be ‘In The Money’? What are the consequences for existing shareholders of a new funding round? How will new warrants dilute existing shareholders value? We offer - Highly specialized info graphics, automatically generated and easy to understand, present and share.

- A proven concept that has been successfully challenged by leading biotech companies and validated by acknowledged accountant firms.

- A ready to-go model and easy to use, flexible tool tailored for your requirements, your specific rules, Shareholder Register and Articles of Association.

- Support and backup from our experienced consultants who hand over the tool to you and train and support you to do the analysis on your own.

Benefits and full support when - Planning new funding rounds and warrants – it is easy to see the effect on the split between investors and share classes quickly and simultaneously.

- Preparing presentations for investors and the Board- high quality outputs like graphs and analysis are automatically generated.

- Conducting funding round discussions – you are able to support your investors showing the split of value created over time and tell the consequences of a new share class for existing investors.

- You need backup, when lacking resources – we can step in and support you to smoothly track the transitions and valuations.

- You would like to minimize errors and time spent on building your own model and formulas.

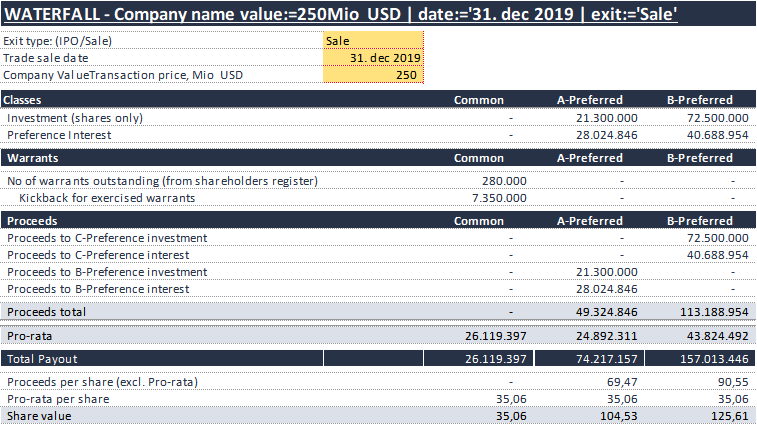

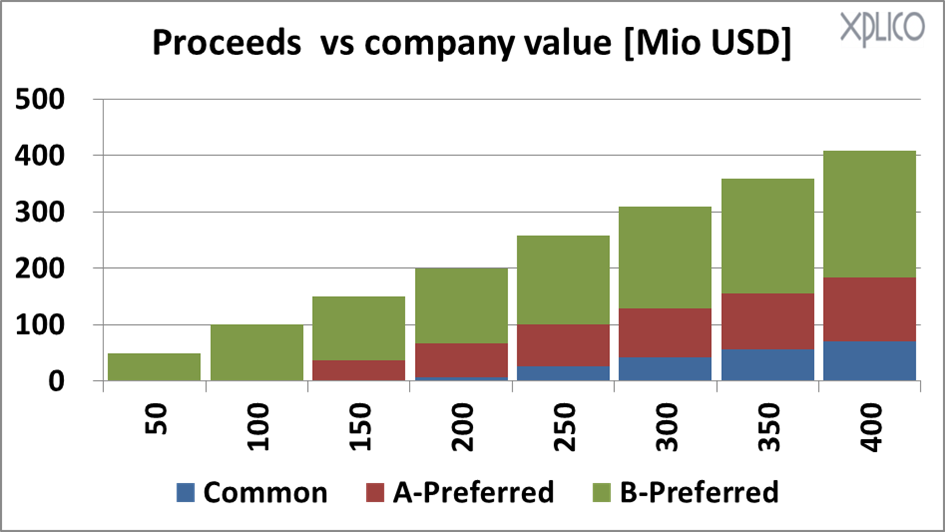

Get started Contact us if you are interested in learning more. We will introduce the model and our services to you and learn about your requirements. We provide a capitalization model tailored for your company, hand it over to you and give you the training to use and maintain the tool on your own, while supporting your analysis all the way when needed – all depending on your preferences. In all cases, our mission is to give you the advantage. Key output features of Xplico CapTableWaterfall Waterfall for all shares, a group or a single investor

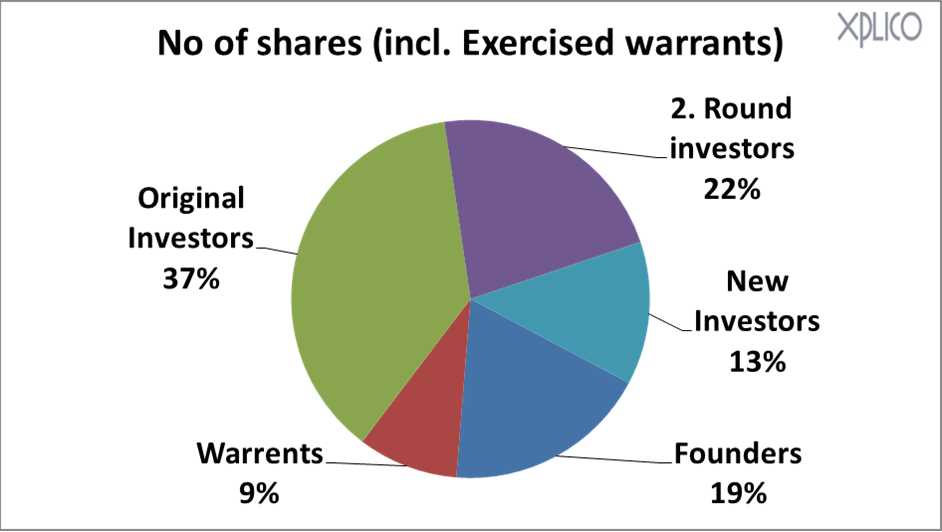

Number of shares per investor Number of shares after dilution and warrants

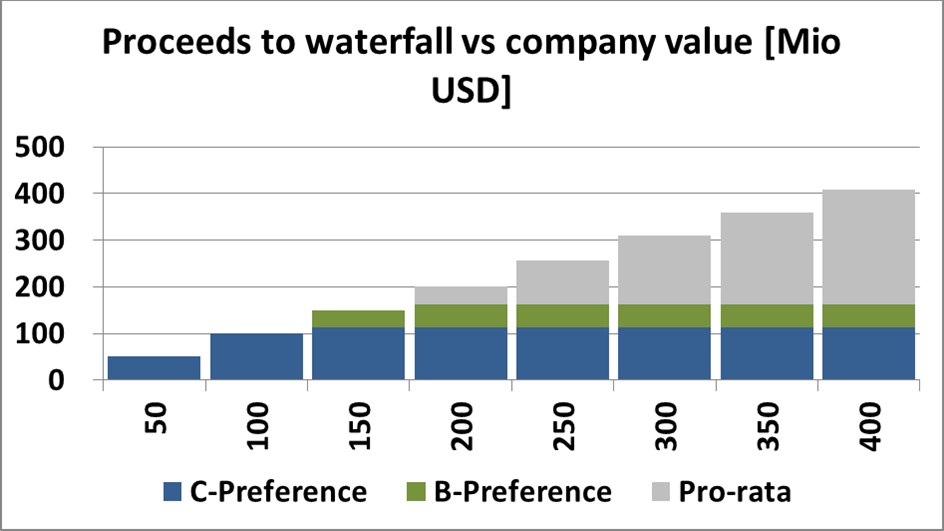

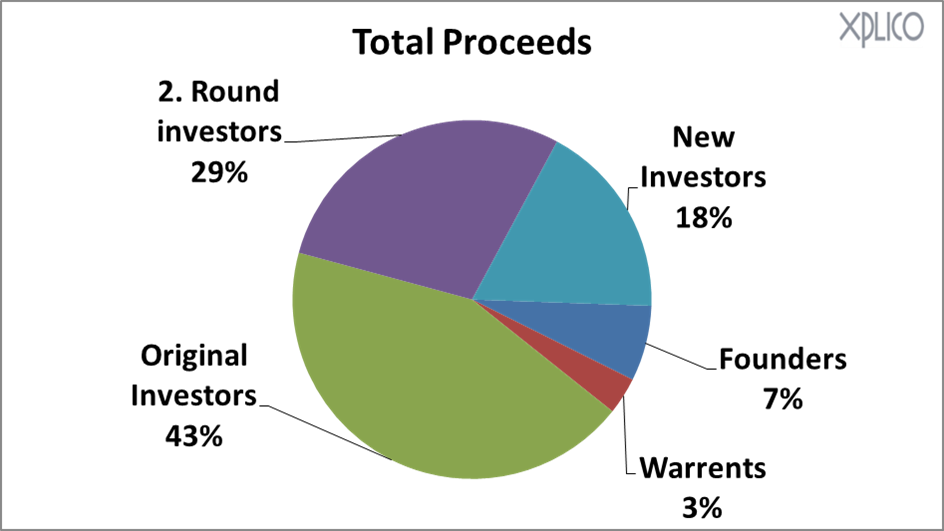

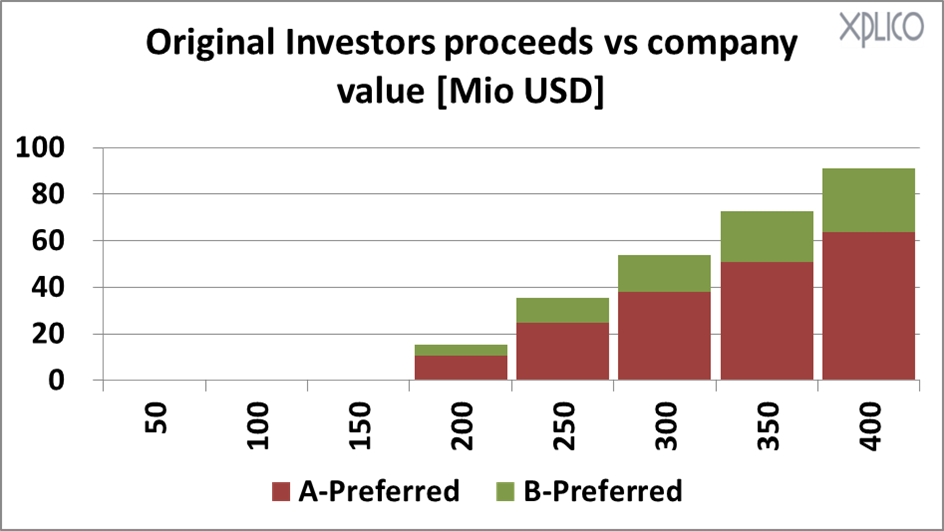

Investment versus Company Value View investment versus proceeds for shares Proceeds per investor The composition of proceeds between investors

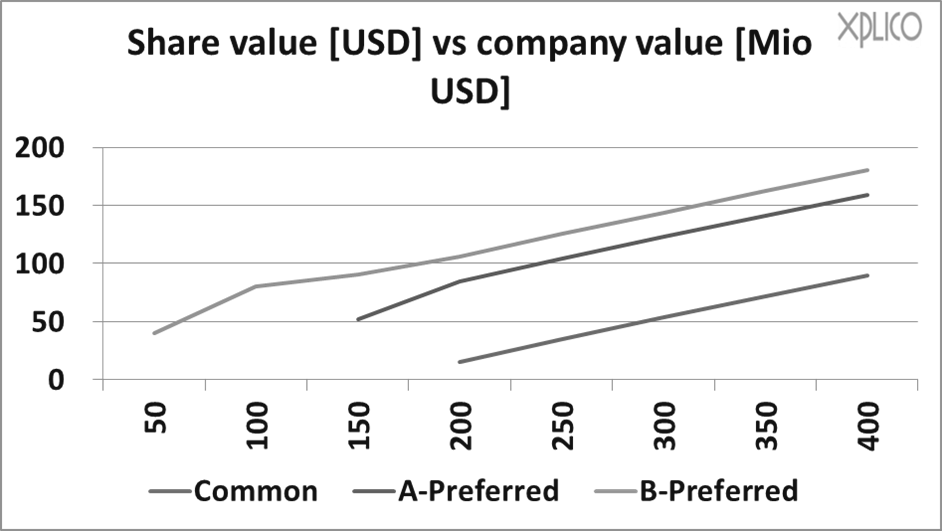

Proceeds per share class When do share classes get "in the money"?

Share value The value of share classes versus the company value

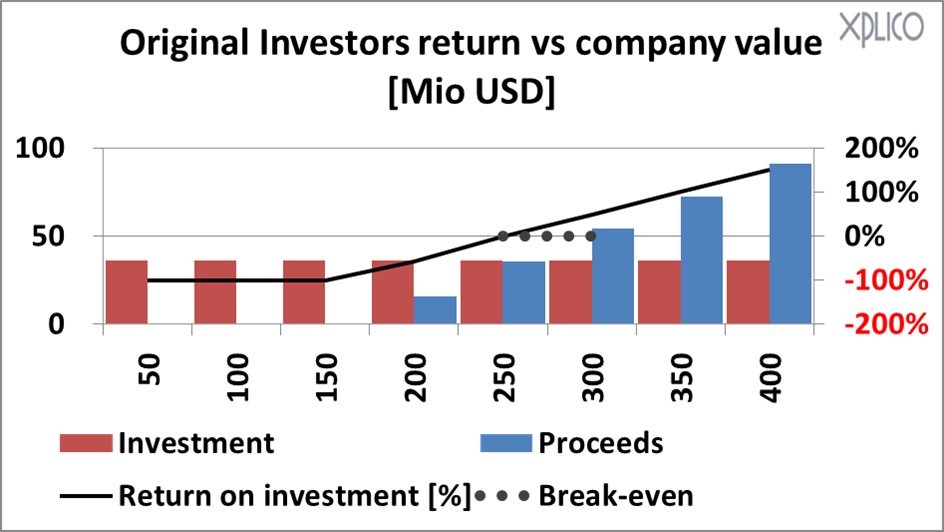

Investment versus proceeds The investment versus proceeds per investor

Proceeds per investor Investors return versus company value for all shares

|